After some years of blue skies, the fires and haze have returned, and these are triggering responses. Malaysia’s Natural Resources, Environment and Climate Change Minister Nik Nazmi blames fires abroad for unhealthy air levels in Kuala Lumpur and other urban centres; Indonesia, however, quickly questions and counters to suggest that Malaysian companies are involved.

Finger-pointing is often the response during bad haze episodes. Otherwise, while complaining, many just bear the situation as a temporary nuisance, counting on changing winds and year-end rains to bring respite. Yet, real and enduring concerns emerge for businesses.

This would, first and foremost, involve companies producing palm oil, pulp and paper as well as other products often implicated in outbreaks of fire. But broader effects are felt, since this is a sizeable sector involving some of the largest companies of Indonesia and Malaysia, and some listed entities in Singapore. Manufacturers that use these products in their supply chains can feel the ripples; so might investors and financial institutions.

Two dangers and one considerable opportunity bear special attention.

Adding heat to the fires

The first danger comes now that the Indonesian authorities are clamping down on the use of fire, which is illegal for businesses. Indonesian authorities are currently pressing legal charges against 11 companies with land concessions in South Sumatra; another 200-plus firms in Kalimantan and other areas have been warned over fires in or near their areas.

Using satellite and hot-spot data, the focus of possible prosecution is on where the fires are burning – and not who started it. Companies with large concessions can therefore face sanctions even if, as many claim, fires were started by nearby smallholders before spreading into their land.

Enforcement measures include imprisonment and hefty fines. Offending companies can also find their concessions sealed off during investigations, interrupting regular operations. There is also reputational risk from illegal and harmful behaviour, that will concern buyers, bankers and investors.

Across different provinces, fire prevention and enforcement readiness on the part of the local authorities can be uneven. But the Jokowi administration is pushing for quick and tough action and has asked the national disaster authorities, police and military to respond to the ongoing situation. For good reason.

Over his two terms, President Joko Widodo has initiated reform and touts these improvements as part of his legacy. The same is true for his Minister of Environment and Forestry Siti Nurbaya Bakar, one of the few ministers to have served throughout Jokowi’s presidency, through Cabinet reshuffles.

Efforts have been made to bring the agribusiness sector and large plantation businesses into line. Only last year, prominent palm oil business leaders were prosecuted for corruption, accused of circumventing price controls and export restrictions during the country’s domestic shortage. There is some expectation that such government efforts will continue even in the last months before elections. For some businesses, this will add heat to the fires.

Making a poor situation worse

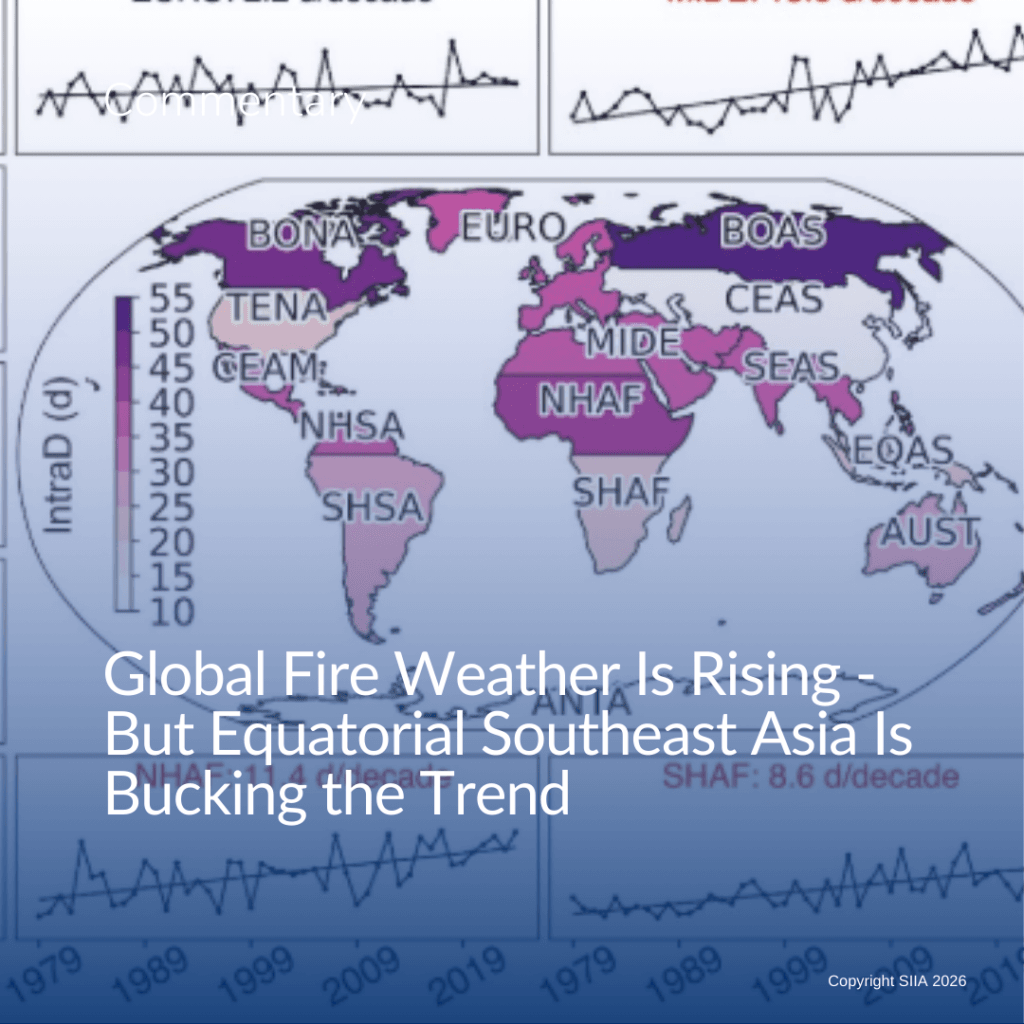

Other factors potentially make the present poor situation worse. One is the weather, the major driver of the fires.

The drier conditions at present result from two phenomena – El Nino and the positive phase of the Indian Ocean Dipole. The weather remains very unpredictable but the dry season could possibly last longer, until perhaps November, and delay the usual rainy season.

Moreover, El Nino tends to be a multi-year phenomenon, and this could also increase fire risks in 2024. The situation could be further compounded by climate change bringing prolonged hot and dry spells, as the world witnessed this year.

A second negative factor is business sentiment, perhaps most notably in palm oil. Many large producers did well of late, on the back of record-high prices. Conditions, however, may now be changing. Some producers complain about elevated costs of inputs and labour, even as productivity remains low and market prices generally soften. Several publicly listed companies are seeing their share prices trending downwards, and some red ink is on the books.

These business concerns tend to impact commitments to battle fires and improve sustainability – efforts that involve considerable time, effort and money. For instance, some companies have invested to increase fire-fighting capabilities and equipment as well as provide incentives and training for local villages to be “fire-free”. There are also efforts to conserve parcels of land for carbon sequestration and biodiversity, and ensure peatlands retain sufficient water to remain resilient to fire during dry periods.

Some companies consider these initiatives as fundamental, and may hope to enhance investor appeal. But others may rethink such practices as margins shrink and pressure mounts to trim expenditures. The temptation to use fire – still the fastest and cheapest method to clear land – can grow.

Headlong expansion or greener path

Many plantations started in the late 1990s to early 2000s and are entering a replanting cycle. Replanting should be done sustainably and many businesses already practise phased replanting to refresh some forest sites each year.

Others, however, do not, and face a situation with debt and weak balance sheets as well as declining yields and the need to spend on replanting. Replanting and opening new areas can therefore run the risk of triggering more fires. This is especially if the next government in Indonesia were to revoke the present moratorium on granting new concession permits for primary forests, and license more land-clearing.

The better alternative is to seek a greener, more sustainable path. Growth would be measured not in the physical expansion of plantations, but in terms of productivity, value to global buyers, and attraction to investors. Demands for that greener path are coming from not only within the best companies but also from the biggest buyers, financial institutions and investors. Greening the sector can secure supply chains against deforestation, reduce carbon emissions, and ensure that the region is free of fires.

Potentially, this would be funded in part by philanthropy and also by generating carbon credits and offering “nature-based solutions” to sequester carbon and reduce emissions. There is a timeliness in this as Indonesia has just launched an emissions-trading system. This is currently a voluntary scheme for only the coal power sector, but there are hopes to expand, with projects for forest conservation and against fires presenting a considerable opportunity.

There remain many factors for nature-based solutions and conservation credits to be accepted and generate revenue. One key factor would be trust. The haze and fires, if prolonged and chronic, can burn that up, and cloud any positive prospects.

Agribusinesses and plantations continue to be important for our region. The sector contributes significantly to the overall economy, especially in rural areas, and involves many – indeed millions – as smallholders. In particular, palm oil in Indonesia has expanded greatly over the past 30 years and plays a vital part in the country’s growth path to become a US trillion-dollar economy. It also plays a major role in the Malaysian economy.

But business-as-usual in this sector cannot continue. Linked to deeper concerns about deforestation and the release of climate change emissions is the key challenge of addressing the fires and the haze for the sector and the major corporations involved. Much can turn for companies in the current rush for fire-fighting, the flurry of investigations, and shifting market trends. But even more will depend on the emerging politics and policies in Indonesia and the global expectations that will shape the conditions for business.

Simon Tay is chairman of the Singapore Institute of International Affairs (SIIA), which hosted the Sustainable World Resources Dialogue on 9 June 2023.

This article is part of a series of SIIA column on “The Politics that Matter to Business” for The Business Times. It was first published on 18 October 2023.